- +91 9725410042

-

Nov 25, 2020.

The equity markets have continued their upward journey further into uncharted waters and, for the first time in the history FPI buying crossed Rs 50,000/- crores in a single month. As mentioned earlier this rally is driven purely by liquidity and low interest rates. The purchases do not seem to have any co relation with the fundamentals. While there is no euphoria, there is very much a sense of nervousness among domestic investors, as suggested from their net sales figures.

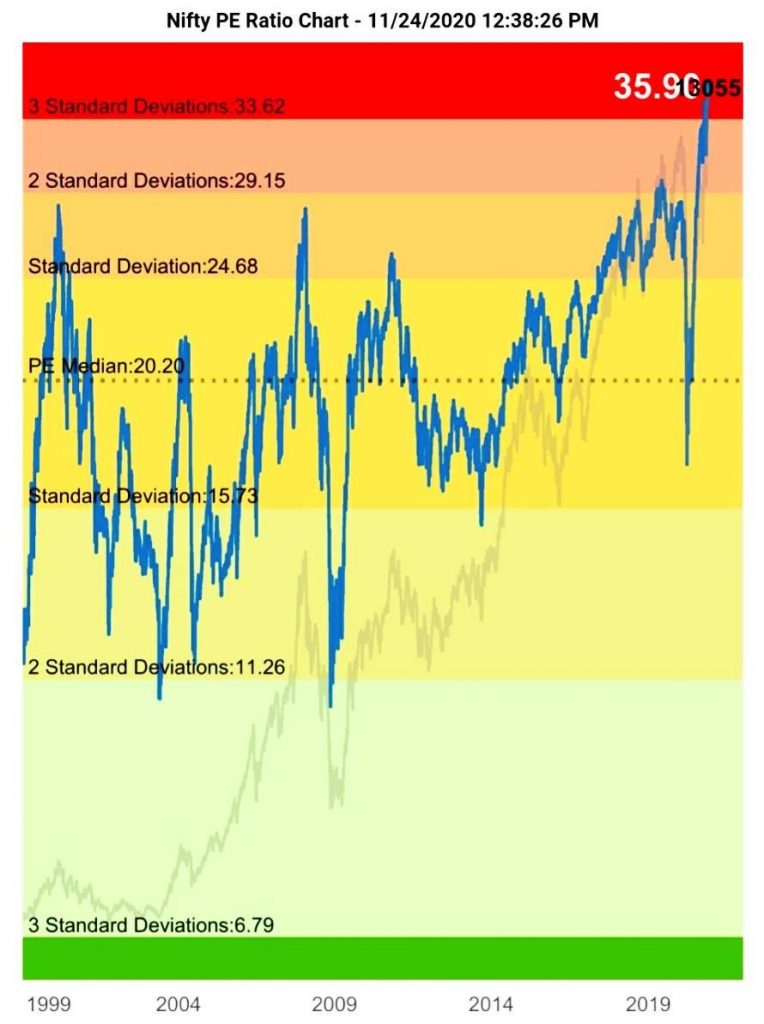

The chart below says a lot about the high and inflated valuations currently.

Nifty P/E : 35.90 ( Double of 23rd March low )

It must be remembered that FII money is hot money. If the dollar appreciates even by 4% to 5%, it will trigger a pull-out from emerging markets and majorly from India. There is a high probability of the March 2020 carnage repeating. Another factor that could trigger a fall will be inflation due to high asset prices and reversal of interest rates.

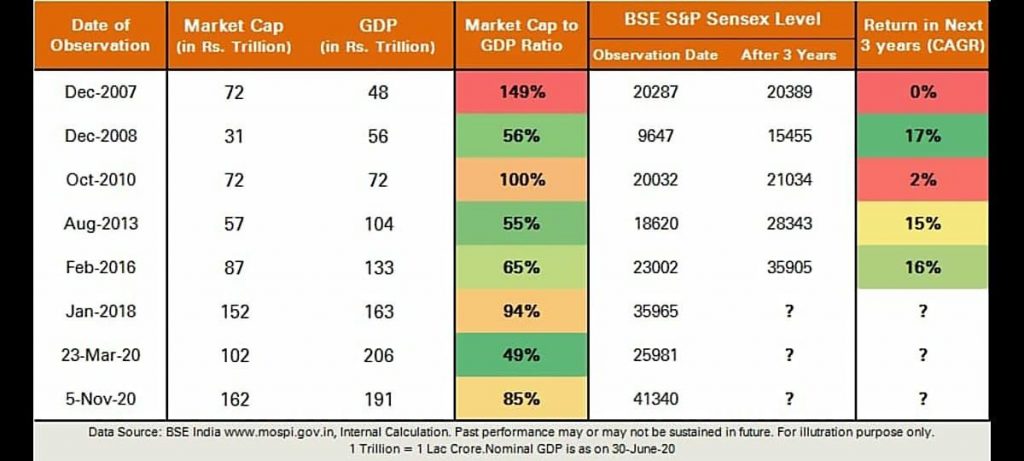

Some analysts are betting on the economic recovery initiated by the covid -19 vaccine discovery and some other factors. Even if it happens the current market levels seem to have priced in that factor. Remember markets are forward looking. So even if there is no major crash, the upside to the equities seems to be capped. The market cap to GDP ratio recently touched 85%.It will be interesting to see what returns were generated over three years when this ratio was at different levels in the past.

( MARKET CAP TO GDP CHART )

Till then uncertainty, news feeds will test investor’s patience and rationality.

Selection of the asset class and its proportion is a very individualistic decision. A very general solution during such times is to follow quants, asset allocation models (depending on one’s conviction of the formulae), so that one is in the right asset class and be protected from down side movements. Down side protection is a significant factor in long term wealth creation.

Indications about a reversal will come from Interest rate charts and that will also be an indication to move out of pure debt funds back to equity in the proportion depending on one’s time horizon and risk profile.

Tags : ,

Sign up to receive the latest news and promotions.

We are Distributors of Financial Products in India & NOT the Investment Advisors as per SEBI guidelines.

Mutual Fund Investments are subject to market risks. Please read all offer documents carefully before investing. There is NO Guarantee of any Returns in the Mutual Fund products.

"AMFI-registered Mutual Fund Distributor"

"ARN - 284652"

Date of initial registration 24th May 2004 valid till 26th Dec 2025

315, Pancham Icon,

Beside vasna DMart,

Vadodara - 390007

02652255191, +917622022853, +919725410042

Copyright © Pragati Funds 2021. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors