- +91 9725410042

-

On 13th May 2020, the govt announced the so-called big bang stimulus amounting to INR Twenty Lac Crore. The industry and experts welcomed it as being more than their expectations. Critics are cynical and say there is no relief , only loans, and deferment of dues. Here we will talk about how it can affect the Mutual fund industry, while the impact of the ATMANIRBHAR Package calls for a separate discussion.

The government announced liquidity scheme worth Rs 30,000 crore and extension of partial guarantee scheme worth Rs 45,000 crore for India’s distressed NBFC sector. This amount is approximately 13% of the first tranche of stimulus and the scale is unprecedented. It strikes directly at the root of the malaise -I L L I Q U I D I T Y.

To understand this we need to go back by two years. One of the biggest NBFCs –IL&FS collapsed in Sept 2018 triggering a crisis of pandemic proportions not only in the financial sector but in the entire economy.IL&FS was a giant ( 23 direct subsidiaries, 141 indirect subsidiaries -including special purpose vehicles for different projects-, 6 joint ventures, and 4 associate companies) sitting on a debt of Rs 91000 crs and had a debt-equity ratio of 18.7 times. Its default had a domino effect on smaller NBFCs and the entire sector. The contagion also affected other investors like banks, insurance companies, mutual funds. The reverberations of this earthquake continued at regular intervals in the form of downgrades of many debt papers, defaults by some well-known corporates, risk aversion by banks to fund NBFCs, and are being felt event today. A sample chain of events works somewhat like this—Investment grade corporates, firms, especially projects were starved of liquidity 🡪, banks and NBFCs were reluctant to finance them,-🡪devoid of funds from the formal system they resorted to an informal sector often resulting in financing long term liabilities with short term funds-🡪 ultimately the asset-liability mismatch culminates in default. Today banks are sitting on Rs 850000 crs of money parked in the reverse repo, but are reluctant to lend to lower-rated papers of NBFCs, mutual funds. The recent decision by Franklin Templeton to wind up schemes whose aum totalled approximately Rs.26,000 crs is result of the same illiquidity malaise confronting the Mutual funds segment. Mutual funds invest in the debt papers of NBFCs.

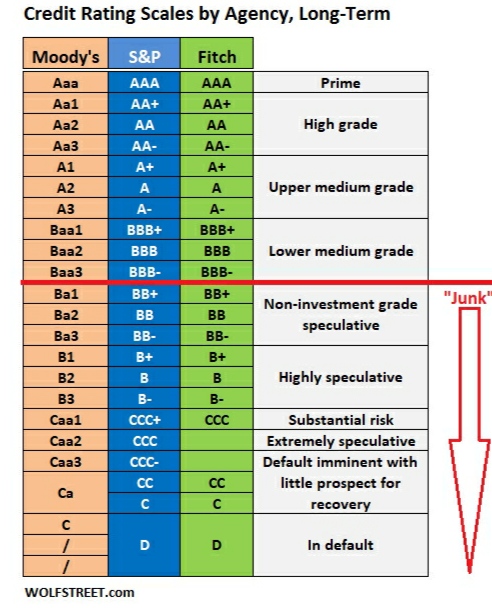

A typical portfolio of a debt mutual fund will have anywhere from 25% upwards exposure to NBFCs.The higher-rated papers have lower yields but are highly liquid. As one moves lower down in the rating profile, the liquidity ( tradeability/ saleability) of papers goes down. When an investor in a debt fund redeems, he is paid out of the proceeds from the sale of underlying papers in the scheme. The fund can have papers with varying ratings. Under normal circumstances the papers are sold at their fair value and liquidity is maintained to service the redemptions. A crisis occurs when at some point of time the redemption rate accelerates to a level wherein the fund manager has to sell the papers at a discount because of their lower ratings or he is forced to sell only the higher rated papers to meet the investor’s redemption requirements. In the latter case, the residual portfolio has a lower rating profile, which further deteriorates its liquidity. The final result is a loss to the final investor and often loss of principal.

Easing of Funding NBFCs which have to battle on two fronts—one delay in receipts of receivable, and servicing papers issued by them to Mutual Funds, banks other investors — will improve their liquidity. The Rs 75000 crore package to NBFC sector is, therefore, a welcome step and will goad banks to break free of their risk aversion and resume lending to the NBFCs.One part of the package comprising of Rs 30000 crs permits investments in investment-grade papers of NBFC both in the primary and secondary market segments. This is fully guaranteed by the government. The other portion of Rs 45000 crs is an extension of the existing partial guarantee scheme wherein AA and lower-rated papers can be invested in. This is a contingent liability for the government but helps the NBFCs.

The Indian Bond market lacks depth. As of Nov 2019, compared to the world bond market of more than 100 trillion USD, the US market accounts for a whopping 40 trillion USD and India at 2 trillion USD.

With the encouragement provided by the govt, the banks will hopefully push credit to NBFCs who are large players especially beyond the reach of the formal banking system. This can be a small but trailblazing effort to deepen and widen the Indian bond market.

Tags : ,

Sign up to receive the latest news and promotions.

We are Distributors of Financial Products in India & NOT the Investment Advisors as per SEBI guidelines.

Mutual Fund Investments are subject to market risks. Please read all offer documents carefully before investing. There is NO Guarantee of any Returns in the Mutual Fund products.

"AMFI-registered Mutual Fund Distributor"

"ARN - 284652"

Date of initial registration 24th May 2004 valid till 26th Dec 2025

315, Pancham Icon,

Beside vasna DMart,

Vadodara - 390007

02652255191, +917622022853, +919725410042

Copyright © Pragati Funds 2021. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors